You’ve just received a bill from your last doctor’s visit, and it looks less like a statement and more like a riddle written in a foreign language. “Applied to Deductible,” “Co-insurance Pending,” “Your Out-of-Pocket Max is…” — what does it all mean? If you’ve ever felt confused, frustrated, or blindsided by your health insurance, you’re not alone.

The language of health insurance is a significant barrier to being a smart healthcare consumer. But knowledge is power—and savings. Understanding a few key terms can transform you from a passive payer into an informed advocate for your own health and wallet.

Let’s break down the essential vocabulary, moving from the most fundamental concept to how your costs are capped.

The Core Four: Your Financial Responsibility Framework

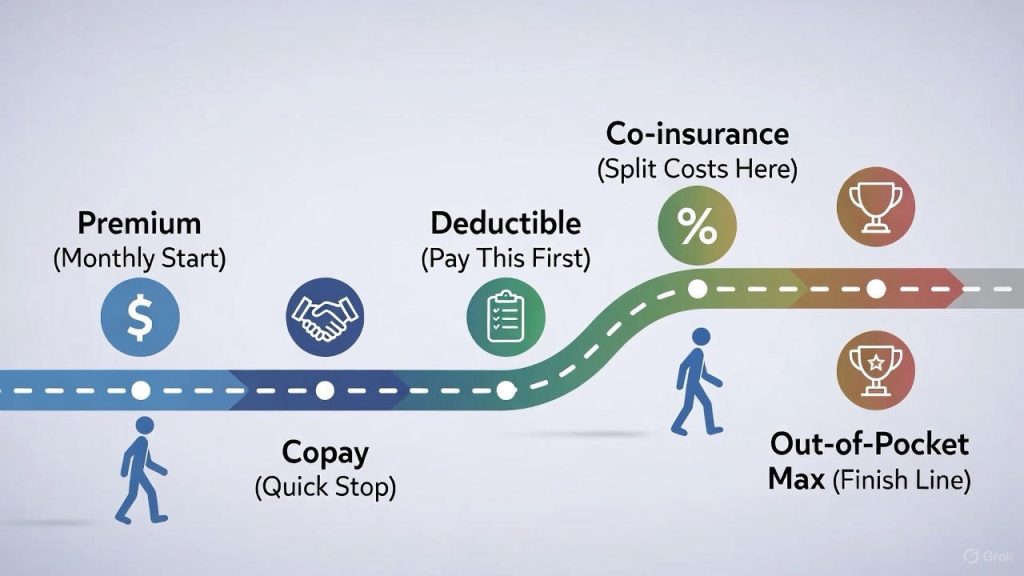

Think of these four terms as a series of doors you pass through in a plan year. Your expenses move through them in a specific order, and understanding this flow is the key to predicting your costs.

1. Premium

· What it is: The monthly fee you pay to your insurance company just to have coverage. It’s like a subscription service or a gym membership.

· Key Point: You pay this no matter what, even if you never use any healthcare services. It does not count toward your deductible or out-of-pocket maximum. A lower monthly premium often means higher costs elsewhere (like a higher deductible), and vice-versa.

2. Deductible

· What it is: The amount you must pay out of your own pocket for covered healthcare services before your insurance plan starts to pay its share.

· Example: If your plan has a $1,500 deductible, you pay the first $1,500 of covered medical costs (like surgeries, hospital stays, or advanced imaging) yourself. After you meet the deductible, you start sharing costs with your insurance through co-insurance.

· Pro-Tip: Not everything applies to the deductible. Many plans cover preventive services (like your annual physical) at 100% with no deductible. Also, you often pay just a copay (see below) for routine visits, which usually doesn’t count toward the deductible. Always check your plan’s Summary of Benefits.

3. Copayment (Copay)

· What it is: A fixed, flat fee you pay for a covered healthcare service, usually at the time of service.

· Example: You visit your primary care doctor. Your plan states: “PCP Visit: $25 copay.” You pay $25 at the clinic, and your insurance covers the rest of the negotiated rate with the doctor.

· Key Point: Copays are typically for predictable, routine services: doctor visits, specialist visits, urgent care, or prescription drugs. They often apply even before you meet your deductible.

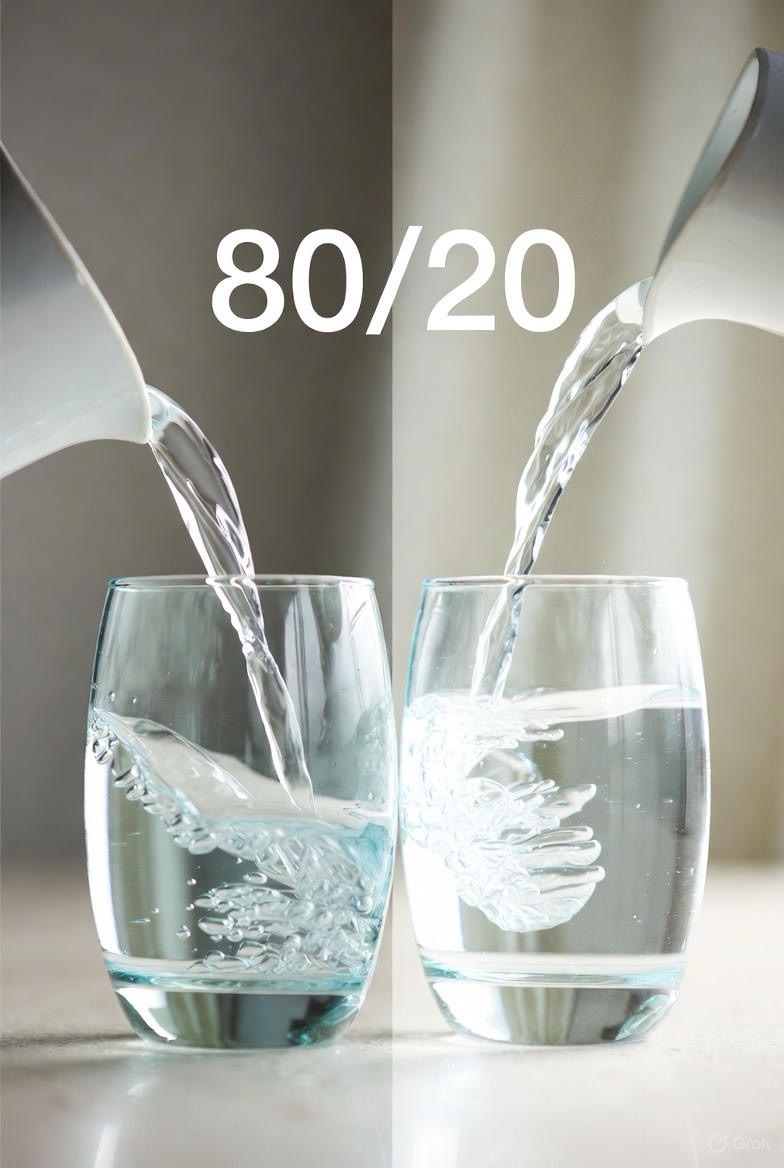

4. Co-insurance

· What it is: Your share of the costs of a covered healthcare service, calculated as a percentage of the allowed amount for the service. This kicks in after you’ve met your deductible.

· Example: You’ve met your $1,500 deductible. You need an MRI. The insurance company’s “allowed amount” for the MRI is $1,000. Your co-insurance is 20%. You pay 20% of $1,000 = $200. Your insurance pays the remaining 80% ($800).

· Visualize It: You and your insurance are now splitting the bill according to the co-insurance ratio until you hit your next stop: the out-of-pocket maximum.

The Finish Line: Your Out-of-Pocket Maximum

5. Out-of-Pocket Maximum (OOP Max)

· What it is: The absolute most you will have to pay for covered medical services in a plan year. After you spend this amount through deductibles, copays, and co-insurance, your insurance plan pays 100% of the costs of covered benefits.

· Crucial Detail: Your premiums do NOT count toward your out-of-pocket max. Also, costs for out-of-network care or non-covered services usually don’t count.

· Why it matters: This is your financial safety net. In a major health event, this number is your worst-case scenario for the year. A lower OOP max means greater protection from catastrophic costs.

Putting It All Together: A Real-World Scenario

Let’s say Alex has a plan with:

· Premium: $300/month

· Deductible: $1,500

· Co-insurance: 20%

· Copay: $30 for PCP, $50 for specialists

· Out-of-Pocket Max: $4,500

In January: Alex pays the $300 premium. They visit their PCP for a sore throat, pay the $30 copay, and get a prescription ($10 copay). These copays likely do not apply to the deductible.

In March: Alex needs minor surgery. The hospital bill is $5,000. They must first pay their $1,500 deductible in full. Now they’ve met the deductible.

For that same surgery: After the deductible, the 20% co-insurance applies. Alex owes 20% of the remaining $3,500 = $700 in co-insurance.

Alex’s total costs so far: $1,500 (deductible) + $700 (co-insurance) + $40 (copays) = $2,240 out-of-pocket.

Later in the year: Alex needs more care. They continue paying 20% co-insurance until their total out-of-pocket spending (from deductible, co-insurance, and copays) hits the $4,500 Out-of-Pocket Max. For the rest of the year, insurance covers 100% of in-network, covered services.

Bonus Terms to Know

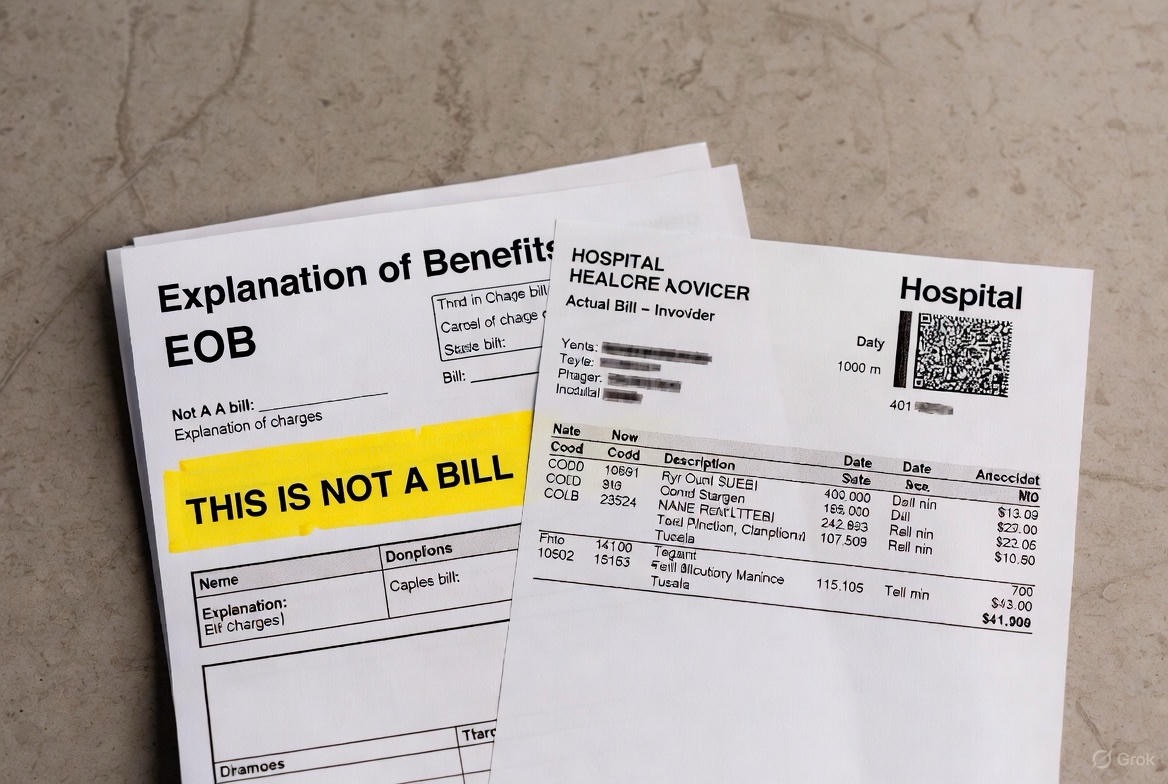

· Explanation of Benefits (EOB): This is NOT a bill. It’s a statement from your insurer showing what was billed, what they allowed, what they paid, and what you owe. Always match it to your actual medical bill.

· Allowed Amount: The maximum amount your insurance plan will pay for a service. If a doctor charges $200 but your plan’s allowed amount is $150, you are only responsible for your share (copay/co-insurance) of the $150, not the full $200.

· In-Network vs. Out-of-Network: In-network providers have a contract with your insurer for lower rates. Using them costs you less. Out-of-network providers do not, leading to significantly higher costs for you and may not count toward your OOP max.

· Prior Authorization: A requirement that your doctor gets approval from your insurance before providing a specific service or medication. If they don’t, your insurance may not pay.

FAQs

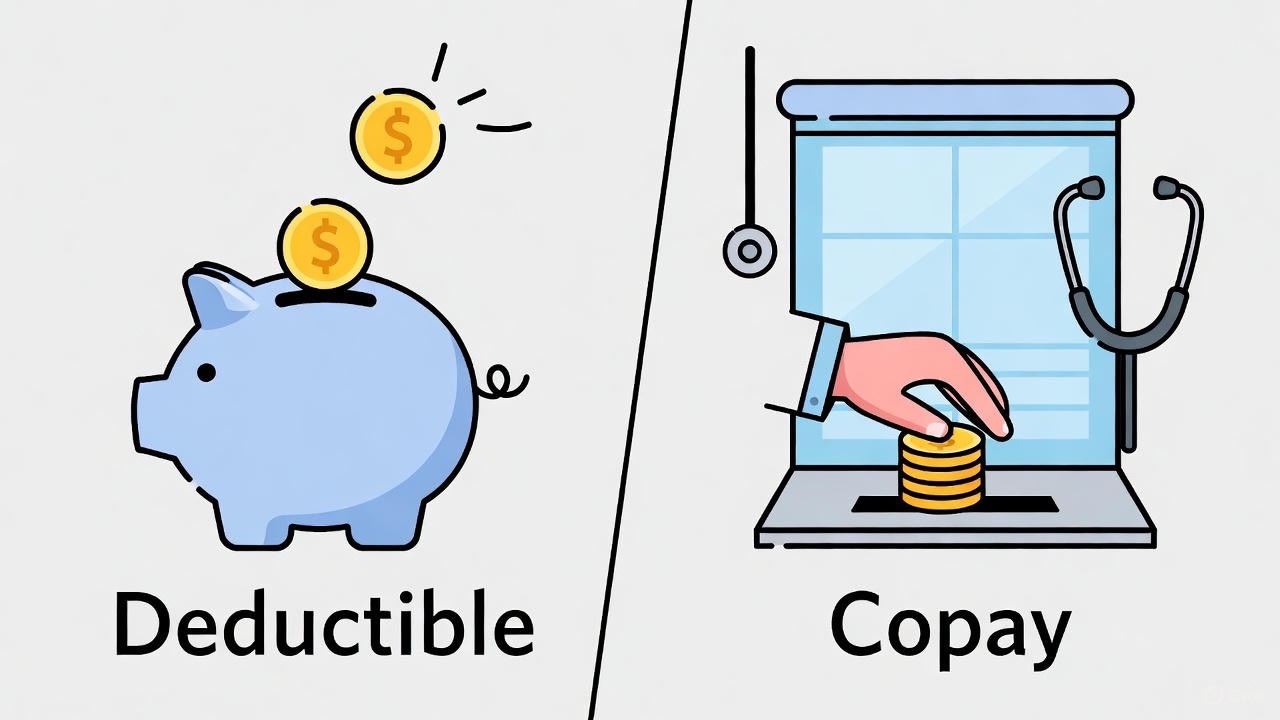

Q1: What’s the difference between a deductible and a copay? Which do I pay first?

A: They’re different types of payments. Think of it this way:

· Copay is usually a flat fee for routine services (like $30 for a doctor visit). You often pay this even before meeting your deductible.

· Deductible is the total amount you must pay out-of-pocket for covered medical services before insurance starts sharing costs via co-insurance.

Which comes first? It depends on your plan. Some services (like preventive care) might only require a copay with no deductible applied. For others (like surgery), you’ll pay the full cost until you hit your deductible. Check your plan’s “Summary of Benefits” for specifics.

Q2: I’ve met my deductible but still got a bill. Why?

A: Meeting your deductible doesn’t mean you stop paying. It means you move to the next phase:

1. Co-insurance: After your deductible, you typically start sharing costs (like paying 20% while insurance pays 80%).

2. Copays: You might still owe copays for certain services.

3. Non-covered services: Some treatments or out-of-network care may not be covered at all.

4. Out-of-pocket maximum: You’ll keep paying your share until you reach this cap.

Q3: Do prescriptions count toward my deductible?

A: It depends entirely on your plan. There are typically three scenarios:

1. Tiered copay system: You pay a set amount ($10/$30/$50) per prescription, which may not apply to your deductible.

2. Co-insurance after deductible: You pay full price until you meet your deductible, then a percentage afterward.

3. Deductible-exempt: Some preventive medications might be covered with just a copay.

Check your plan’s drug formulary – it lists how different medications are covered.

Q4: What’s the difference between “out-of-pocket maximum” and “annual limit”?

A: This is crucial:

· Out-of-pocket maximum (OOP max): The most you will pay for covered services in a year (includes deductible, copays, co-insurance). After this, insurance pays 100%.

· Annual/lifetime limit: The most insurance will pay for covered services. The Affordable Care Act banned lifetime and most annual dollar limits for essential health benefits, so you’re more likely dealing with an OOP max.

Key difference: Your OOP max protects you from catastrophic costs. An annual limit would cap what insurance pays (largely eliminated for essential care).

Q5: Why is my bill higher than my copay amount?

A: Several reasons:

· You haven’t met your deductible: You’re being charged the full negotiated rate, not just the copay.

· Additional services: The copay might cover the visit only, not tests or procedures done during the visit.

· Out-of-network provider: Even if the facility is in-network, a specific doctor (like an anesthesiologist) might not be.

· Balance billing: Some providers may bill you for the difference between their charge and what insurance allows (less common with in-network providers).

Q6: What happens if I switch jobs/plans mid-year? Does my deductible reset?

A: Yes, typically. When you enroll in a new plan (through a new job or during open enrollment), you start fresh with that plan’s deductible and out-of-pocket maximum. There’s no carryover from your previous plan.

Exception: If you’re continuing coverage under COBRA from a previous employer, it’s the same plan, so your deductible progress continues.

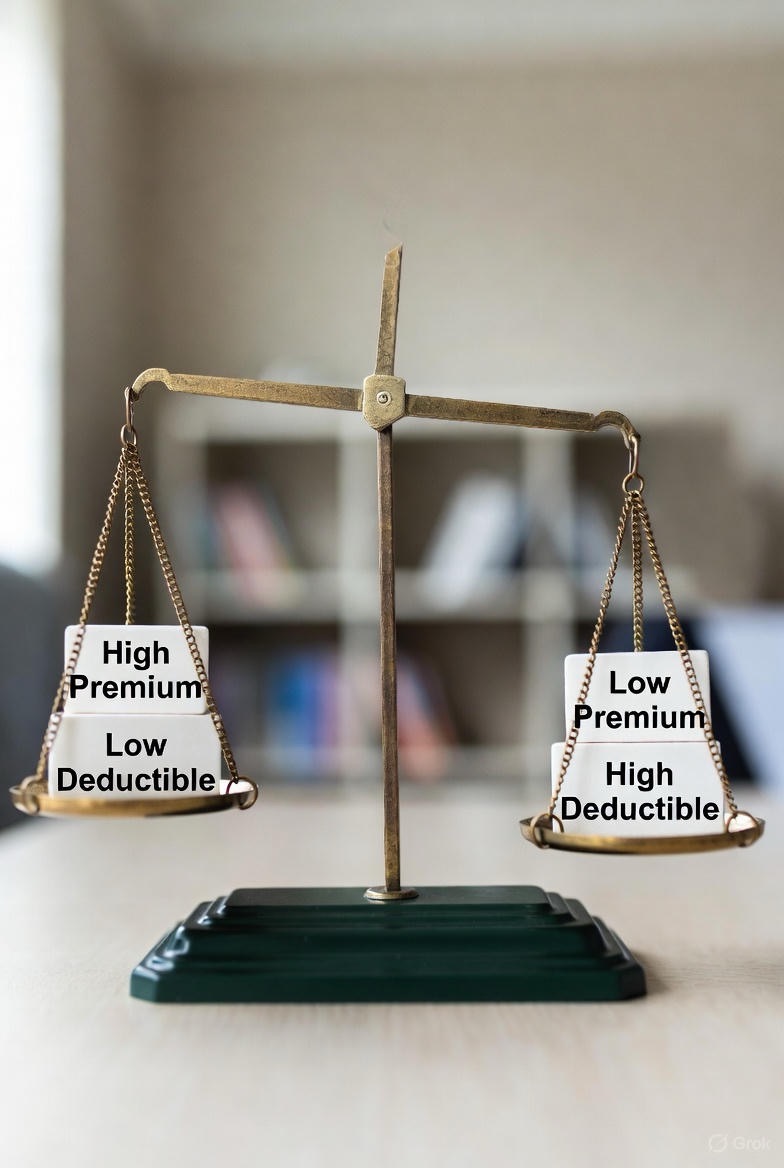

Q7: Is it better to have a high-deductible or low-deductible plan?

A: It depends on your health needs and financial situation:

· High-deductible plan: Lower monthly premiums, but you pay more upfront for care. Often paired with an HSA (Health Savings Account) for tax advantages. Best for: Generally healthy people who want lower monthly costs and can handle higher out-of-pocket expenses if needed.

· Low-deductible plan: Higher monthly premiums, but you pay less when you receive care. Best for: People with chronic conditions, expecting major procedures, or who prefer predictable costs and comprehensive coverage.

Q8: What exactly does “allowed amount” or “negotiated rate” mean?

A: This is the maximum amount your insurance company has agreed to pay for a specific service with an in-network provider. It’s usually less than what the provider initially charges.

Example: Doctor bills $200 → Insurance’s allowed amount is $130 → You pay your percentage (co-insurance) of the $130, not the $200. The provider writes off the remaining $70.

Q9: How do I know if something is “in-network”?

A: Always verify three ways:

1. Check your insurer’s provider directory (online or call them).

2. Confirm with the provider’s office (“Do you participate with [Insurance Company] Plan [exact plan name]?”).

3. Ask if all involved are in-network (for procedures: the facility, surgeon, anesthesiologist, lab).

Never assume based on a general list or past experience—networks change frequently.

Q10: What’s an HSA and how does it work with my deductible?

A: A Health Savings Account (HSA) is a tax-advantaged savings account for medical expenses. Key points:

· Eligibility: You must be enrolled in a qualified High-Deductible Health Plan (HDHP).

· Tax benefits: Contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-free.

· Use it for: Deductibles, copays, co-insurance, dental, vision, and many other qualified expenses.

· It’s yours forever: Unlike a “use-it-or-lose-it” FSA, HSA funds roll over year to year.

Q11: Why did I get an EOB (Explanation of Benefits) if it’s not a bill?

A: The EOB is a summary from your insurer showing:

· What was charged

· What your plan allows

· What they paid

· What you owe (your responsibility)

You get it so you can verify that the actual bill from your provider matches what the insurance company says you should pay. It’s your audit tool.

Q12: What if I can’t afford my medical bills even after insurance?

A: Take these steps:

1. Review for errors: Compare the bill to your EOB.

2. Negotiate: Call the billing department. Providers often offer payment plans, discounts for prompt payment, or financial assistance programs.

3. Ask about cash price: Sometimes the cash price (without insurance) is lower than your co-insurance share.

4. Get help: Nonprofit organizations like the Patient Advocate Foundation or Dollar For can provide assistance and resources.

Understanding these concepts transforms you from a confused consumer into an empowered patient. When in doubt, call your insurer’s customer service line—write down the rep’s name, ID number, and the date/time of your call for reference. Your financial health deserves as much attention as your physical health.